Refinancing in the U.S.: A Guide to Seizing Opportunities

Refinancing In The U.S.: A Guide To Seizing Opportunities

By

Ann

|Last Updated: 12 Sep 2024

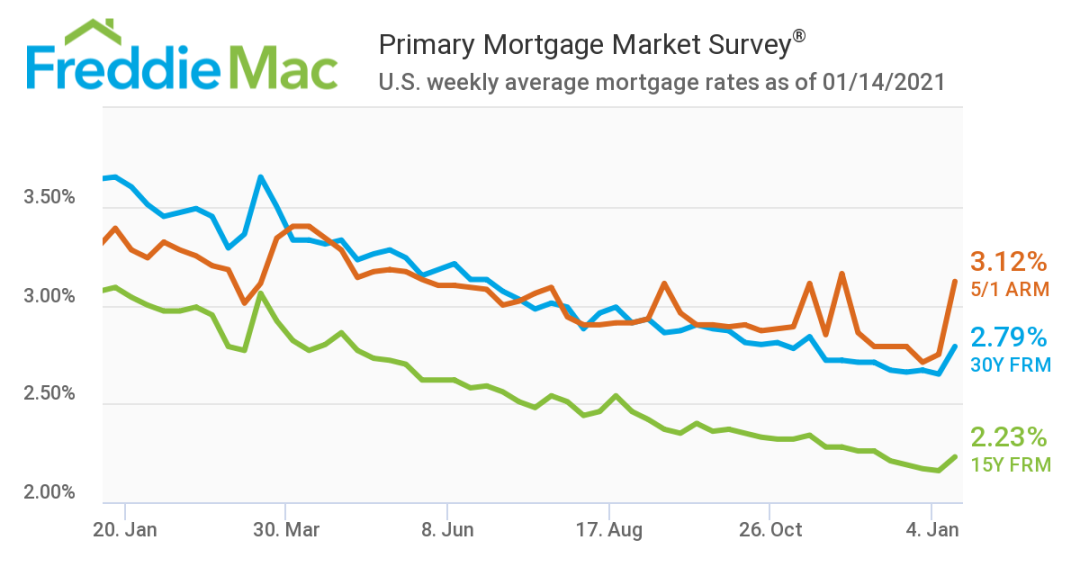

The United States is currently experiencing a three-year low in mortgage interest rates, making it an opportune time to consider refinancing.

When is the best time to pursue this financial strategy?

What is Refinancing?

Refinancing, is essentially the process of obtaining a new loan to replace an existing one, while continuing to repay the debt. The total debt amount remains unchanged, and the essence of the mortgage loan remains the same – what changes is the repayment structure. Refinancing acts as a remedy when better loan options become available.

1. Adjusting Loan Terms:

- Altering the loan term can be done during the refinancing process.

2. Utilizing New Interest Rates:

- Repayment can continue with the new loan's interest rates.

When to Consider Refinancing:

Refinancing aims to secure more favorable interest rates and terms. However, applicants should be aware of one-time bank settlement fees associated with refinancing. Consider refinancing when:

1. Improved Credit Score:

- As credit scores influence loan interest rates, an increase in credit score may lead to lower interest rates. For instance, with a higher credit score, refinancing a $750,000 loan on a $1 million home from 4.5% to 4% could save $2,628 annually.

2. Adjustable-Rate Mortgage (ARM) Adjustment:

- If an Adjustable-Rate Mortgage (ARM) is due for adjustment and market rates are increasing, refinancing to a fixed-rate mortgage may be advantageous.

3. Substantial Expenses:

- Significant expenses like home renovations can be funded through a "Cash-out Refinance." This involves increasing the loan amount to receive cash. For example, with a home valued at $120,000 and a current loan of $750,000, refinancing to $775,000 can provide an additional $25,000 for expenses.

Benefits of Refinancing:

1. Interest Savings:

- Lower interest rates, especially over the extended term of a 30-year loan, can result in substantial savings.

2. Reduced Monthly Payments:

- By restarting the loan term during refinancing, monthly payments can decrease, providing more disposable income.

3. Shortened Loan Terms:

- Refinancing can either extend or shorten the loan term, with the latter often securing a lower interest rate.

4. Consolidation of Loans:

- Multiple loans can be merged into one, simplifying debt management, especially during declining interest rates.

Considerations for Refinancing:

Despite its benefits, refinancing has its pitfalls, and careful consideration is crucial to maximize advantages:

1. High Transaction Costs:

- Closing costs during refinancing typically range from 3% to 6% of the loan amount. Weigh these costs against potential savings.

2. Loss of Existing Benefits:

- New loans may have lower interest rates but might lack previous perks. Evaluate which option maximizes overall benefits.

3. Potential Increase in Total Interest Paid:

- While monthly payments may decrease, extending the loan term could result in paying more interest in the long run.

4. Property Revaluation:

- Reappraise the property as its value may have changed since the original purchase.

5. Holistic Assessment:

- Consider all aspects, including interest rates, loan terms, and fees, to make an informed decision.

Refinancing in the U.S. offers significant advantages when timed and executed correctly. Remember, a comprehensive evaluation is key to ensuring the best possible outcome.